Industry Overview

Laser-risk environments require eyewear that goes beyond standard protective glasses. The Laser Defense Eyewear market sits at the intersection of lasers’ technical advancement and eye-safety culture. Whether in cutting-edge manufacturing, tactical defence operations or laser surgeries, protective eyewear must deliver high durability, clarity, comfort and compliance with safety standards. Moreover, as companies adopt energy-efficient and sustainability-driven procurement practices, eyewear that supports long lifespan and minimal replacement becomes part of a broader sustainable safety strategy.

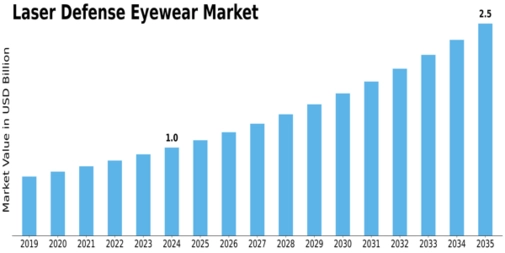

Market Outlook

MRFR places the market at USD 1.04 billion in 2024, growing to USD 1.126 billion in 2025 and reaching USD 2.495 billion by 2035, with a CAGR of 8.28% for the decade ahead (2025-2035). These figures reflect accelerating investment in protective technologies and emphasise that laser-eyewear is no longer niche but a strategic item in PPE (personal protective equipment) frameworks.

Key Players

Companies driving innovation in this market include Honeywell, 3M, Revision Military, Oakley, Bollé, Smith Optics, ESS Eyewear, Pyramex Safety and Radians. Their portfolios span polycarbonate and glass lens options, modular frame systems, and tailored solutions for sectors such as defence, healthcare and manufacturing. For instance, military-grade glasses emphasise impact-resistance and weight-reduction, while medical-grade goggles prioritise clarity, fitting and comfort for long procedures.

Segmentation Growth

By Application: Military leads; medical next fastest-growing due to surgical lasers.

By Product Type: Safety glasses largest; goggles fastest growth as precision work escalates.

By End Use: Defence largest share; healthcare growing fastest.

By Material: Polycarbonate remains preferred; glass is rapidly gaining adoption; acrylic remains moderate.

Regional Perspective: North America leads with USD 0.48 billion in 2024 and forecast to USD 1.2 billion by 2035. Europe: USD 0.34 billion → USD 0.85 billion. APAC: USD 0.15 billion → USD 0.45 billion. South America: USD 0.04 billion → USD 0.10 billion. MEA: USD 0.03 billion → USD 0.30 billion.

Conclusion

For industry stakeholders—especially those managing protective-gear procurement—the Laser Defense Eyewear market Analysis offers actionable insights. The segmentation reveals where investments should focus: for example, healthcare environments may benefit from glass-lens goggles, while defence may continue with polycarbonate glasses. The growth trajectory also reinforces that eyewear procurement should be aligned with broader safety, sustainability and operational-efficiency goals.